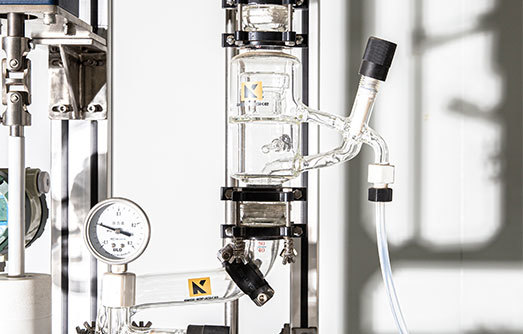

Glass Reactor Technology – Reproducibility and Scalability in Chemical Experiments

Glass reactor technology has revolutionized the field of chemical experimentation by offering both reproducibility and scalability, essential attributes for advancing chemical processes. These reactors, made predominantly from borosilicate glass, are favored for their chemical resistance, thermal stability, and optical clarity, which together enhance the precision and control of experimental procedures. The glass’s resistance to thermal shock and its ability to withstand a wide range of chemical reactions make it an ideal material for conducting experiments that require rigorous conditions. Reproducibility in chemical experiments is crucial for validating results and ensuring that findings can be consistently replicated. Glass reactors facilitate this by providing a controlled environment where variables can be precisely managed. The transparency of glass allows for real-time monitoring of reaction progress, which aids in adjusting parameters as needed to maintain consistency. Additionally, the uniformity in the design and construction of glass reactors means that experiments can be replicated with a high degree of accuracy, reducing the likelihood of errors and variability.

This consistency is particularly beneficial in research and development phases, where small deviations can lead to significant differences in outcomes. Scalability, on the other hand, refers to the ability to expand experimental processes from small-scale laboratory settings to larger production environments. Glass reactors are designed with scalability in mind, enabling researchers to transition smoothly from bench-scale experiments to pilot-scale and eventually full-scale production. This is achieved through modular designs and standardized dimensions, which allow for easy scaling up of reactions while maintaining the integrity of the results. GWSI using similar materials and designs at various scales, researchers can ensure that the characteristics of the reactions remain consistent, facilitating a smoother transition from laboratory to industrial applications. One of the key advantages of glass reactors is their versatility. They can be equipped with various accessories such as temperature controllers, stirrers, and sensors, which enhance their functionality and allow for precise control of experimental conditions.

This adaptability not only aids in reproducibility but also supports the scaling process by ensuring that the same level of control can be maintained across different scales. For instance, precise temperature control is crucial for certain reactions, and glass reactors with built-in temperature regulation systems can provide the necessary consistency to achieve reproducible results. Moreover, the ease of cleaning and maintenance associated with glass reactors contributes to their effectiveness in both reproducibility and scalability. The non-porous nature of glass ensures that residues from previous experiments are easily removed, reducing the risk of cross-contamination and ensuring that each experiment is conducted in a pristine environment. This is particularly important when scaling up, as any contamination could affect the entire production batch. In summary, glass reactor technology significantly enhances both reproducibility and scalability in chemical experiments. The material’s properties, combined with its design versatility and ease of maintenance, provide researchers with the tools needed to achieve consistent and reliable results across various scales. This technology not only supports the rigorous demands of scientific research but also facilitates the practical application of experimental findings in industrial settings, bridging the gap between laboratory discoveries and real-world applications.